birgitizn05755

About birgitizn05755

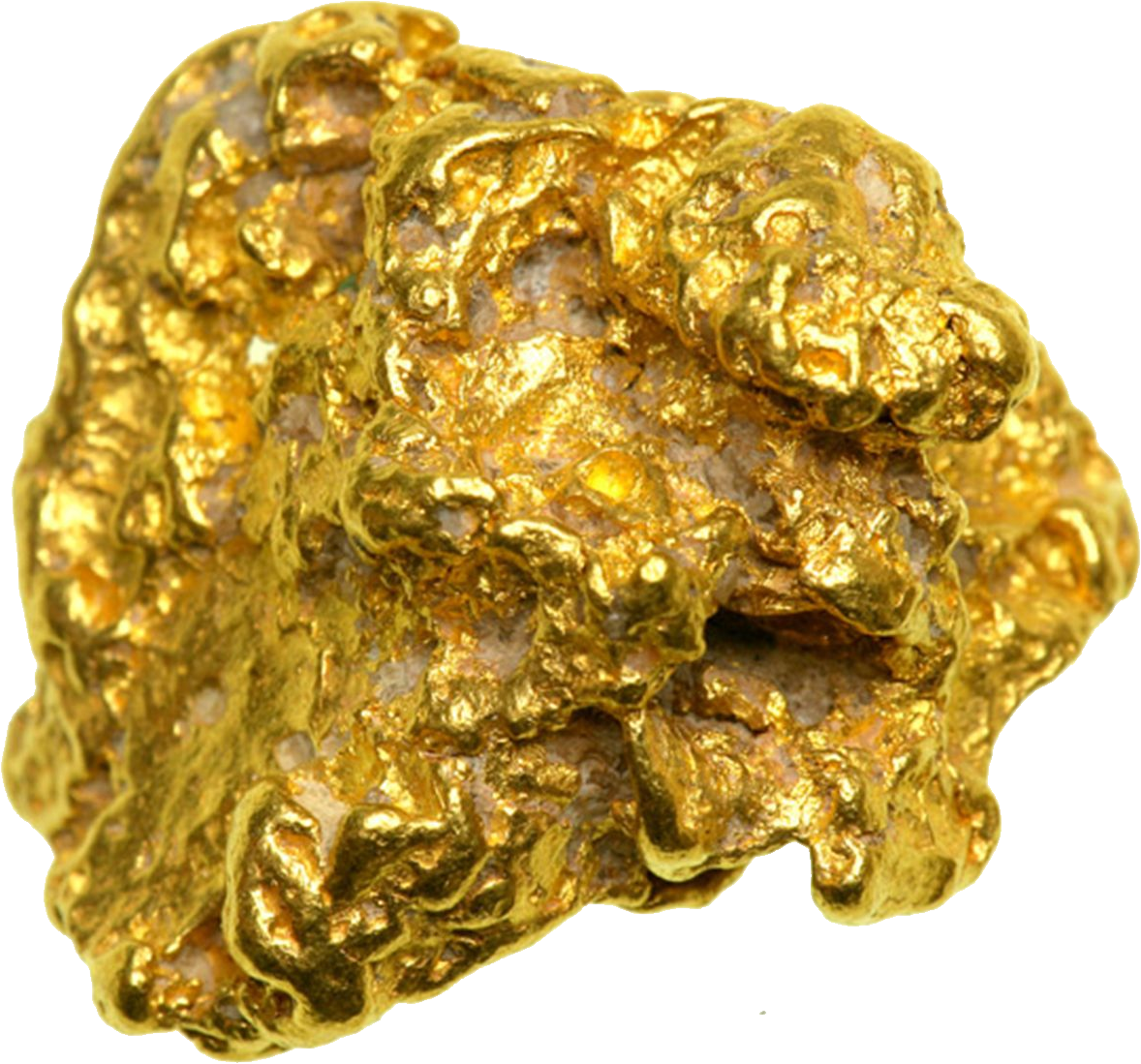

Investing in Gold IRAs: A Comprehensive Guide To Safe Your Financial Future

irasgold https://irasgold.com;

In recent times, the idea of investing in a Gold Particular person Retirement Account (IRA) has gained important traction amongst buyers seeking to diversify their portfolios and protect their wealth from market volatility and inflation. A Gold IRA permits individuals to hold physical gold and other valuable metals inside their retirement accounts, providing a hedge in opposition to economic downturns and foreign money fluctuations. This article explores the current developments in Gold IRAs, highlighting the benefits, the technique of setting one up, and the considerations to bear in mind.

Understanding Gold IRAs

A Gold IRA is a type of self-directed IRA that permits the inclusion of physical gold, silver, platinum, and palladium as a part of the funding portfolio. In contrast to conventional IRAs that sometimes hold stocks, bonds, and mutual funds, a Gold IRA permits buyers to hold tangible assets which have intrinsic worth. The first appeal of Gold IRAs lies in their potential to function a safeguard in opposition to inflation and market instability.

The advantages of Investing in Gold IRAs

- Inflation Hedge: Gold has historically maintained its value over time, making it an efficient hedge towards inflation. When the purchasing energy of fiat currency declines, the value of gold usually rises, protecting investors’ wealth.

- Diversification: Including gold in an funding portfolio can present diversification, lowering overall risk. Gold usually behaves in a different way from other asset courses, which might help stabilize returns throughout market fluctuations.

- Tax Advantages: Gold IRAs provide the identical tax advantages as traditional IRAs. Contributions could also be tax-deductible, and investments grow tax-deferred until withdrawal, permitting for potential tax savings over time.

- Tangible Asset: Unlike stocks and bonds, gold is a physical asset that traders can hold. This tangibility can present peace of mind, particularly during occasions of economic uncertainty.

- International Demand: Gold is universally acknowledged and valued, making it a liquid asset that can be simply purchased or sold in markets around the world.

Establishing a Gold IRA

The technique of establishing a Gold IRA has develop into more streamlined and accessible, due to developments in know-how and the emergence of specialised custodians. Here are the steps to set up a Gold IRA:

- Choose a Custodian: Step one is to select a custodian that focuses on Gold IRAs. Custodians are monetary institutions accountable for managing the account and ensuring compliance with IRS regulations. It is essential to decide on a reputable custodian with experience in precious metals.

- Open an Account: After deciding on a custodian, the following step is to open a Gold IRA account. This entails filling out the necessary paperwork and offering identification and financial information.

- Fund the Account: Buyers can fund their Gold IRA via numerous methods, including rollovers from existing retirement accounts, direct contributions, or transfers from other IRAs. It is very important observe IRS tips to keep away from penalties.

- Choose Treasured Metals: Once the account is funded, traders can select which precious metals to incorporate of their Gold IRA. The IRS has specific necessities for the sorts of metals that qualify, including certain purity standards. Frequent choices include American Gold Eagles, Canadian Gold Maple Leafs, and numerous bullion bars.

- Buy and Retailer the Metals: After deciding on the metals, the custodian will facilitate the purchase and ensure that the metals are saved in an approved depository. The IRS mandates that valuable metals in a Gold IRA must be saved in a safe, IRS-permitted facility.

Present Traits and Innovations in Gold IRAs

The Gold IRA market has seen a number of notable advancements in recent times, making it easier for buyers to access and manage their investments:

- Online Platforms: Many custodians now supply user-pleasant online platforms that permit investors to handle their Gold IRAs easily. These platforms provide actual-time pricing, transaction history, and account administration instruments, making it more convenient for investors to watch their investments.

- Increased Consciousness: As extra people become conscious of the benefits of Gold IRAs, demand has surged. Financial training assets, webinars, and informative articles have made it easier for potential investors to understand some great benefits of gold as part of their retirement technique.

- Enhanced Security: With the rise of cyber threats, custodians have implemented advanced safety measures to guard buyers’ belongings. This contains multi-factor authentication, encryption, and insurance options for stored metals, guaranteeing that buyers’ holdings are safe.

- Diverse Funding Choices: Investors now have access to a broader vary of precious metals and funding choices within their Gold IRAs. This includes not solely gold but also silver, platinum, and palladium, allowing for better diversification within the portfolio.

- Regulatory Clarity: Recent developments in rules surrounding Gold IRAs have offered clearer guidelines for investors and custodians. This has helped build belief in the market and encouraged more individuals to contemplate gold as part of their retirement planning.

Concerns Earlier than Investing in Gold IRAs

While Gold IRAs provide numerous benefits, potential traders ought to consider several elements before making a call:

- Charges and Prices: Gold IRAs might include numerous charges, including setup charges, storage charges, and transaction charges. It’s crucial to understand these prices and how they may impact total returns.

- Market Volatility: Although gold is commonly considered as a safe haven, its price can still expertise volatility. Buyers should be prepared for fluctuations in value and consider their threat tolerance.

- Lengthy-Time period Funding: Gold IRAs are finest suited to lengthy-term investors. These searching for fast positive factors may discover different investment options more interesting.

- IRS Regulations: Traders must adhere to IRS laws regarding Gold IRAs, together with the types of metals that qualify and the storage necessities. Failure to comply can lead to penalties and taxes.

Conclusion

Investing in a Gold IRA could be a strategic transfer for individuals trying to diversify their retirement portfolios and safeguard their wealth towards inflation and financial uncertainty. With developments in technology, elevated awareness, and enhanced security measures, the technique of setting up and managing a Gold IRA has turn into extra accessible than ever. Nonetheless, potential investors ought to carefully consider their options and conduct thorough analysis before committing to this investment strategy. By understanding the advantages and challenges of Gold IRAs, individuals could make informed selections that align with their lengthy-time period monetary targets.

No listing found.